I think it is fair to say that if I knew the answer to this question I would be a very rich man! However, like many economists, the best I can do is try to analyse some important data and make some informed predictions. Therefore, here are some of my thoughts about what could potentially happen to the stock market post the 3rd of November! I hope you enjoy.

On November 3rd, 2020 the world will be glued to their screens. Whether it be through their televisions, phones or tablets everyone will be watching and listening with bated breath. Who will be the next president of the United States? Will it be the current POTUS and Republican Donald Trump? Or will he be usurped by the Democrat and former vice President Joe Biden? Perhaps right now it is just too close to call. Biden may be ahead on many pre-election polls, however, many polls also suggested Hilary Clinton was ahead four years ago and we all know how that ended…don’t we…

With the risk of making this a political blog rather than a financial blog, I will do my best to focus purely on the financial side. This way I can do my best to stay fair to both candidates.

Okay…let us start with Mr Donald Trump. What will happen to markets if he becomes re-elected? I think the best place to start with Trump would be to look at what happened to markets when he was elected for the first time in 2016. Anyway it is said that history repeats itself…right?

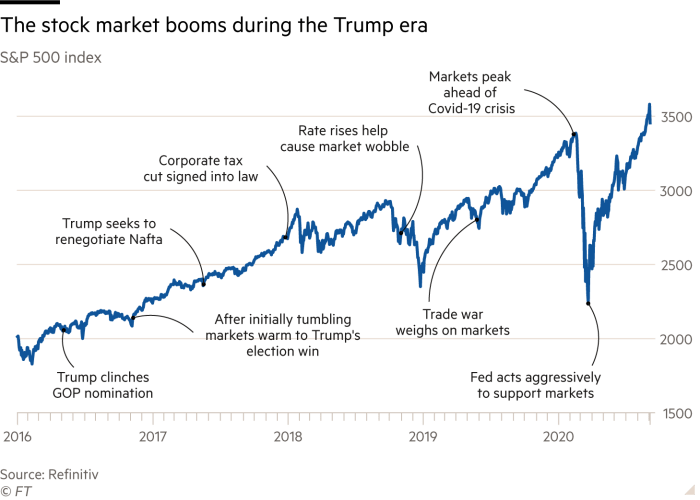

Above I have borrowed a brilliant image from the FT that shows the effect Trump has had on the S&P 500 throughout his presidency and some of the key moments along the way. As we can see there has clearly been a meteoric rise. Trump’s determination to keep the stock market growing throughout his presidential term is evident. A combination of the relentless pressure that he has put on Jerome Powell and the Fed to keep interest rates low and his own determination to keep taxes low has seen markets react in an extremely bullish way over the last 4 years. Even with the crisis of the global pandemic we can see that both Trump and the Fed have acted aggressively to support markets with the S&P 500 actually passing its pre-pandemic highs. Therefore, one could make a very strong case that this may well happen again if he is to be re-elected.

Furthermore, analysts from J.P Morgan Chase have argued that if Trump is re-elected we could expect to see the S&P 500 shoot past the 3,900 mark and a jump of 14%. They argue that a victory for the Red party would result in bullish investing and consequently a dramatic increase in the stock market.

“analysts from J.P Morgan Chase have argued that if Trump is re-elected we could expect to see the S&P 500 shoot past the 3,900 mark and a jump of 14%”

J.P Morgan Chase

While I do believe that we will see an increase in the stock market in the immediate short term, I still have my queries about what the future of the stock market would hold if Trump was to be re-elected. The global pandemic has put a huge strain on all global markets and the US is no different. Furthermore, with the US being so deeply divided at the moment, it is not implausible to see a sharp decline in equities. With the political fragility in the US, I could see investors looking towards safe havens in gold and government bonds in an attempt to keep their money safe in an unpredictable climate.

Now what could happen if Joe Biden wins? Will we see a bearish reaction in markets? Will equities crash like we have never seen before? Trump certainly thinks so as he has even said that “if he is elected, the stock market will crash.” Or will we see some stability across markets? I believe that Biden is in a really difficult position when it comes to the stock market. If he is to become the next president of the United States he will inherit an economy that has constantly been pumped with different financial stimulus to keep it rising. Therefore, it is inevitable that markets will, in the immediate aftermath, act bearish if he was to be elected as there is no way he would implement the aggressive financial tactics of Trump. Furthermore, Biden has also promised an expansive infrastructure plan that will require tax payers’ money. Investors are worried that Biden’s increase in taxes will cause a huge sell off across the stock market.

“if he is elected, the stock market will crash.”

Donald Trump on Joe Biden

However, I do potentially see some opportunities to be bullish for the stock market if Biden is elected. While initially markets may be bearish on Biden, I believe there is potential for his presidency to bring some stability to markets. Unlike Trump, it is hard to imagine Biden going on twitter rampages that cause violent reactions in markets. This may lead some long term investors to enjoy that stability and trust that he can sustain manageable growth in the stock market. Furthermore, with Trump’s failure to guarantee a peaceful transferral of the presidency (if Biden was to win), investors are now quite happy to accept a comprehensive blue victory. A troublesome handover of power would be the absolute worst for investors as they will likely be unwilling and skeptical to enter into the stock market.

In conclusion. I think the one thing that markets can definitely expect, regardless of who is elected president, is volatility. Investors from around the world will be hanging on every news report, data release and sound bite over the next week as they begin to hedge their positions. Proprietary traders and intraday traders will certainly be looking to take advantage of the market volatility. For the long term investors it is probably wise to let the dust settle before jumping into any long term positions.

What will really happen? Only time will tell…